On June 16, 2021, a new article by Corey Costa about NFT’s appeared on Official Medium page of Aergo.

The author of the article provides information about CCCV and Aergo.

We present the content of this article below:

The Inception Of NFT’s Has Created A Craze: Will It Last And Have NFT’s Progressed Beyond Just Hype?

Introduction: Hype vs. Utility: Which Foundational Ethos Causes The Transcendence of Blockchain Ecosystems?

Throughout the history of blockchain, it has become more and more evident and obvious that hype is a cornerstone of a blockchain ecosystems success, specifically surrounding token price and awareness of the project. Ethereum’s infrastructure smart contract code capabilities transformed the zeitgeist of blockchain, enabling different projects to be built on Ethereum. This notion conceived of the “Great ICO Bubble Of 2017” which led to new projects skyrocketing in valuation without real-world utility. When “The Great Bear Market of 2018” commenced, investors succumbed to digital shell-shock, coming to the clear realization that many of these projects were extremely hyped but lacked utility. Fast forward to 2021, although hype is still a fundamental zeitgeist of the blockchain sphere, utility is becoming the superior and aggrandizing force. Will NFT’s meet the same fate as the ICO Bubble of 2017, or is there something deeper that is incumbent to analyze surrounding real-world utility? Lets delve deep into the intricacies of NFT’s and how projects like AERGO have created revolutionary innovations surrounding NFT expansionism.

What Are Non Fungible Tokens? The Modern Day Tulip Craze, Or Real World Value?

NFT’s have exploded during The Great Bull Run Of 2021, and it is important to recognize the intricacies of what NFT’s are. Non Fungible Tokens is a digital asset(s) that represents real-world objects such as art, music, in-game items, videos, collectible cards, an essay, a unique-sneakers and clothes etc. NFT’s are similar to cryptocurrencies in a variety of different ways, specifically highlighted by their similarities in cryptographic coding. The inception of NFT’s began in 2014, but their popularity has soared over the last two years, and since 2017, over 174 million dollars has been spent on NFT’s. But where do NFT’s garner their value, and why?

NFT’s main valuation proposition is the inception of digital scarcity. In the traditional exterior world, rarity breeds value, surplus leads to hollowness in many circumstances (see every single monetary currency that has succumbed to runaway inflation since the dawn of humanity). Within the digital world, rarity also breeds value, specifically in an entire consolidated web of an infinite supply of the majority of creations. It is evident that NFT’s hold a value proposition, but how far has NFT’s evolved since the Great NFT Craze of 2020 began?

Value In Non-Fungibility: The NFT Paradigm Of Evolution

Since the inception of NFT’s, many artistic renderings have been anything but unique. Many NFT’s began as a digital copy of a creation that was already in existence somewhere else. Clips from iconic sporting events to securitized versions of artistic expression that already existed on social media outlets such as Instagram, Facebook and Twitter all became amalgamated under the umbrella term known as an NFT. So if NFT’s can be basically seen, screenshotted, downloaded and/or printed, how does this create an exterior value proposition; the answer is ownership. NFT’s allow the buyer to own the digital item; NFT’s enable such a digital feat through digitized authentication which can lead to owners garnering a sense of uniqueness surrounding their ownership of such a unique piece of data. Since the creation of NFT’s in 2014, the function and maxim’s of owning these pieces of data have evolved substantially, and we’re going to find out why and how.

NFT’s have created numerous different opportunities for celebrities, musicians, and artists to expand their business models in a variety of different ways. Artists, to begin, can utilize and add stipulations to an NFT to ensure that they receive a portion of proceeds every-time that specific NFT is sold. NFT’s, because they provide digital ownership rights through a unique paradigm, eliminate the need to track an asset’s progress and the need to enforce entitlements associated with any sale of that property. NFT’s can also benefit musicians who can utilize them to provide special perks to fans. It is also evident, to any collector, that it can be extremely difficult to point out what is a genuine collectors item or a reproduction; NFT’s end that dilemma. NFT’s with clear transaction histories back to the original creator would eliminate such an issue that has plagued collectors for far too long. NFT’s have the potential to transform the paradigm of digital ownership, and I believe NFT’s have evolved into the “Vision and Real World Application” stage, rather than blatant hype without a valid sense of utility.

The Dilemma Of NFT’s: The Great Expense: Different Blockchains Look To Solve The Issue

The largest breeding ground for minting NFT’s, as of 2021, is Ethereum. Unfortunately, just like expensive transaction fees that plague the Ethereum Blockchain, minting an NFT has unfortunately met the same fate. Although there is a complete guarantee of decentralized digital ownership when an NFT is issued on Ethereum, scalability and high costs plague the network. Many blockchains have attempted to rectify the high cost dilemma of minting NFT’s, blockchains such as Tezos have created scalable solutions that allows for NFT’s to be mint in as little as two minutes and cost approximately .50 cents per mint.

Blockchains such as Aergo and ICON have also created their own NFT platforms where individuals can ensure the movement and minting of their NFT’s for a fraction of what it would cost on Ethereum. Scalability and high transaction costs have plagued blockchain networks since the inception of Bitcoin and different blockchain projects have been working tirelessly to create a seamless, affordable and efficient digital paradigm for NFT’s to be minted and sold on.

Future Use Cases Envisioned: The Practicality of NFT’s

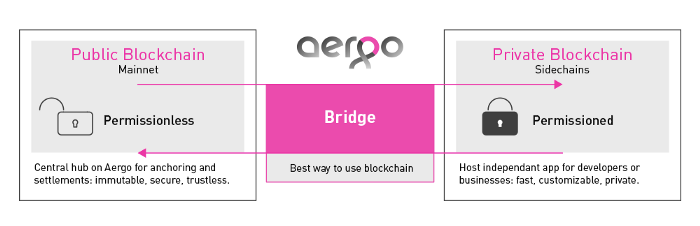

Ownership has unfortunately been in the hands of middlemen before the birth of NFT’s, but future potential can rectify this paranoia of changing hands of ownership. Similarly to smart contracts, NFT’s enable a reliable transfer of information between two or more parties. NFT’s enable assets to reliably move around within a blockchain system, and blockchain systems such as Aergo are creating bridges where NFT’s can be transferred from a side-chain of the network to a main network. NFT’s can resolve a variety of issues that coincide with land and vehicle ownership. Did you know that less than 40% of the global population has their land registered to the rightful property owner? NFT’s can fix this! Individuals who lack verifiable defined rights find it much more difficult to access financial services and credit. With NFT’s, individuals can verify their rights through original ownership attached to their property through digitized verifiable authentication.

Aergo’s Merkle Bridge: Bridging The Gap: Rectifying Dilemmas

Ask yourself a focal and important question about interoperability from a humanistic and primal standpoint; if tribes can’t communicate through a similar language, how can civilization evolve as a whole? Its a simple answer, we couldn’t of. In the 21st century, one of the main dilemmas blockchains face (as digital tribes) is the inability to communicate with one another. Interoperability is blockchains next step, its destiny as a digital innovation.

The Merkle Bridge is designed to become a bridge between different blockchains and side-chains, enabling blockchains to talk with one another and exchange value in a cost effective manner. Multi-sig operators are the main and predominant form of data transfers in blockchain systems, unfortunately, a lack of security and increased costs plague this type of transference paradigm. Small transfers cannot exist with this type of paradigm because costs are incredibly high. Aergo fixes such a notion through the utilization of the Merkle Proof Tree, which is less costly and more efficient than the Ethereum Patricia Tree; however, Aergo intends on developing bridges between Aergo and Ethereum. Now how can this benefit NFT’s when utilizing the Merkle Bridge?

Merkle Bridge’s technology can benefit not only individuals attempting to transfer tokens, but data and information as well such as NFT’s. Merkle’s Bridge can be seen as a type or oracle-feed between different networks that are interconnected through the Merkle Bridge. Many centralized institutions and blockchain projects have issued their own NFT’s without the ability of cross-chain functionality and transference. With Merkle Bridge, NFT’s can be transferred to “wallets” that connect to Aergo and Ethereum and in the future, other blockchain projects connected to Merkle Bridge. Interoperable NFT transfers, as interoperable protocols are inevitable, the future of NFT’s are fated to be consolidated with the interoperable paradigm.

AERGO Incubated: An NFT Use Case Utilizing CCCV

Since February 2020, it is evident that COVID-19 has conceived of an onslaught against our modern civilization that hasn’t been seen for at least 100 years. Nations closed and economic regimes were brought to their knees against an ancient paradigm that humanity has never truly conquered and risen victorious: The Great Biological War. Blockchain enterprises realized that immutability and transparency thereof could assist in the inception of tracking the virus through vaccine verifications; Aergo understood this notion to the fullest extent. Aergo and Blocko XYZ conceived of an incubated project known as CCCV which enables individuals who have their COVID vaccination to identify themselves as vaccinated by adding a real-time badge and sticker that can be shown to others who utilize the platform. In South Korea, an apparent dilemma is that COVID badges are only given to individuals over the age of 65, that leaves a massive age demographic where identifying who is vaccinated and who isn’t is incredibly difficult to track. CCCV solves this dilemma. Although companies have created COVID vaccination tracking apps, security and standardization have been a focal issue; with CCCV, users can request a badge and a sticker and when the document of their verification is authenticated, it is uploaded to their account. Now how does this tie into NFT’s, Ill tell you.

CCCV has garnered over 2 million subscribers (roughly 1.3 times the population of the island of Manhattan) and offers numerous different services which include NFT services. CCCV is a social networking platform and professional person validator, simultaneously, NFT’s can be implemented into this platform and its 2 million plus subscribers! Fake online impersonations, false influencer credentials and fraud are unfortunate but occur incredibly often in cyberspace and NFT’s can solve such an issue through unique-original-digital-ownership through the utilization of CCCV. NFT’s service as an authenticity technology that prevents users from succumbing to SNS linkage and enables individuals to create unique personalized design badges that emphasizes personal ownership and authenticity of ones profile. The platform is blockchain based: immutable, trustless and reliable. NFT’s also enable individuals to control the ownership of their own credentials and CCCV provides such a service utilizing this technology. CCCV has a multitude of use-cases which amalgamate digital identity verification, COVID-19 vaccination status and authenticating digital ownership through NFT’s.

Conclusion: Envisioning An Evolved NFT Paradigm

It is evident that since the inception of NFT’s in 2014, the concept and expansion of non-fungible tokens has occurred exponentially over the last seven years. We have seen over 170 million dollars spent on NFT’s since 2017, different blockchain projects creating their own NFT marketplaces, effectively competing with Ethereum by creating low-cost and scalable alternatives, and we’re beginning to see the availability of cross-chain NFT technology. The overall future prospect of NFT’s is yet to be seen, but for what we can empirically observe now, we can presume that NFT’s have a bright future.

Disclaimer: Cryptocurrency and NFT investing requires substantial risk, do not invest more than you can afford to lose! I am not a financial adviser and I am not responsible for any of your trades. It is incumbent that you always do your own research before investing in anything!