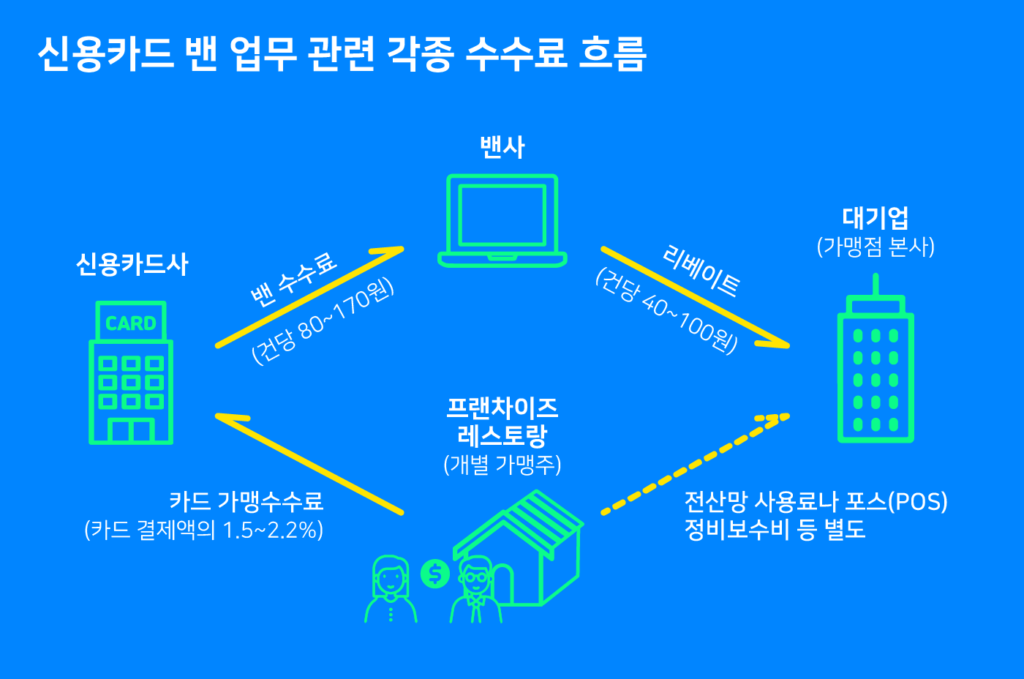

Payment processing is an extremely complex system that involves several intermediaries; it isn’t as easy as sending monetary value from the consumer to the merchant. Let’s make an easy to understand example of such a notion. An office worker pays by credit card after eating at a franchise restaurant. It is evident that the transaction occurred between two people, the office worker and the restaurant owner, however many intermediaries are involved with one payment. These intermediaries can cause inefficiencies and additional costs for the business owner. This complexity is one of the focal components on why many businesses charge an additional processing fee when paying with a credit card as opposed to a cash transaction. Countless intermediaries and contracts form the basis of even the smallest of payments; at your local 711 or deli, an innocuous three dollar transaction can turn into a convoluted process where multiple systems must become involved. This creates a problem for the small business owner.

Since the beginning of the COVID-19 Pandemic specifically, small businesses in particular have seen the degradation of their businesses. This is due to a number of reasons which include shutdowns, a slowdown in economic expenditures and now, a looming supply crisis and payment processing only adds to these multiple nuisances. Many contract structures that provide convenience and risk management to the business owner in return conceive of a high commission burden to that specific small business owner. This is a fundamental flaw in the payment processing paradigm. Naturally, it is evident that the burden of this fee must be borne by the individual franchisees and the consumer. An easy and innovative payment service must be the answer, and one is on the horizon, GemPay.

Ask yourself this question, and answer it honestly, has fintech and big tech platforms enhanced the monetary performance of your business, or retracted upon it and left it in economic stagnation? It is an honest question that every small business owner should be asking. At the end of 2021, the fee for small merchants with annual sales of 300 million won ($250,000 USD) or less was only .08% for credit cards. However the percentage for Naver Pay is 2.2% (order management) and 2.0% for Kakao Pay (online), higher than the majority of card processing companies. It has been analyzed that the approximate fee is 2–3 times higher. It has become difficult to simply compare fee rates because of the broad range of services that credit card companies and simple payment operators provide. Of course, it is true that it is difficult for everyone to know transparently about the standards and specific details of processing fees. But we must ask ourselves about the fundamental maxim of big tech service companies, whose sole purpose is for-profit business. Are big tech service companies competing to provide quality services for their customers rather than financial companies that are subject to stricter audit and regulatory restrictions? Even so, it will be just a temporary marketing to dominate the market and that creates a major dilemma.

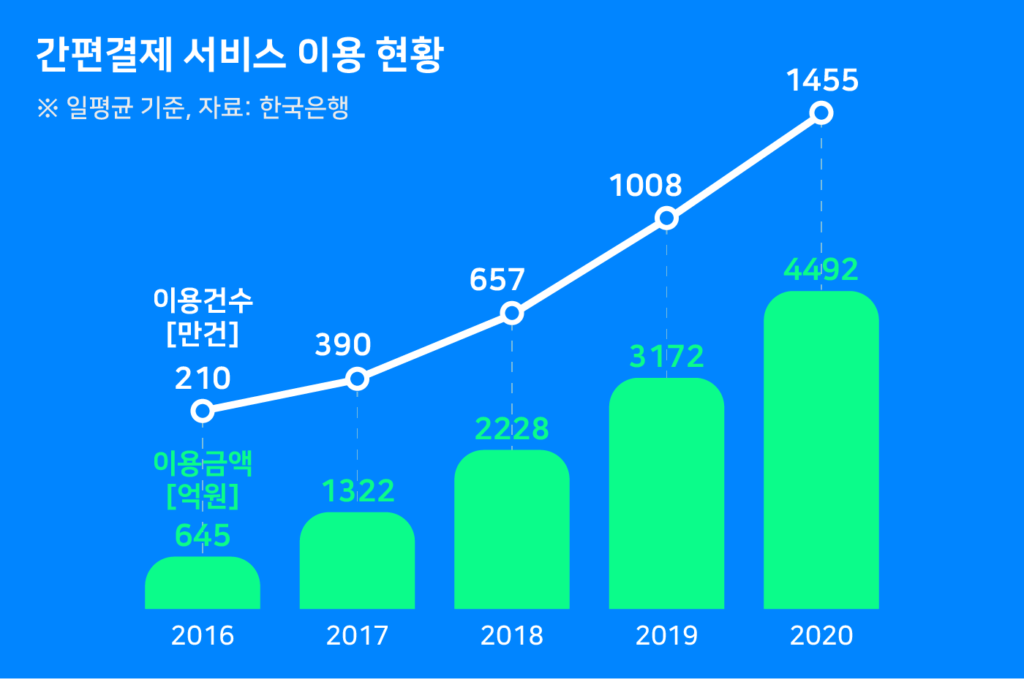

The fact that the development of technology has made it possible for consumers to easily consume is certainly a benefit of fintech technology; resulting from this, more people and business entities experience convenience and versatility. ‘Easier’, ‘faster’ and ‘kinder’ have become essential features of all services as technological innovation has increased astronomically over the last two decades. However, for sellers, this means higher fees and more platform dependencies which perpetuates the ability for payment processing platforms to price gouge processing fees because of the “leverage of reliancy.” We are not just satisfied with the simplicity of the service, but can actually increase the benefits that we can receive from the huge platform created with data and aggregation. This is where GemPay comes into play, developed by Blocko XYZ.

Blocko XYZ is an incredibly forward thinking company that creates blockchain solutions for enterprises of all sizes. GemPay is a convenient solution to the major processing fee dilemma that small business owners face. Bitcoin and blockchain technology are great solutions to these problems, but they have unfortunate dilemmas as well which include scalability, high transaction fees, exploits, slow transaction times and bottlenecks. After consistent deliberation and study of the mechanics of blockchain technology, Blocko was able to collect the following three notions to successfully integrate and amalgamate into GemPay. Beginning with the first pillar, the philosophy entailed is this “accept the notion of eliminating payment intermediaries and borrow the concept of point discounts to increase discounts instead of fees!” The second pillar highlighted is “let’s become the subject of the service by transparently sharing the transaction process, such as payment details and discount rates, and allowing users to exercise their own choice in operation!” And lastly, the third pillar is thus “keep the value 1:1 with the legal currency, so let’s focus on the points that can be easily paid rather than the investment purpose!”

The first pillar highlights the ethos of decentralized blockchain technology, comparing it to its non-traditional notions in accordance with the existing financial system. The core principle of blockchain is decentralization. Through blockchains the fee dilemma can be resolved by excluding electronic payment agencies (in essence, removing the oligopolist middle-men such as Payment Gate PG) and value added networks that are interconnected in the payment process. In English, buyers and sellers are directly connected through a peer-to-peer paradigm without the necessity of third parties, which results in virtually zero commission costs. Because GemPay is a blockchain based payment system, a “double discount” is possible.

The second ethos of GemPay revolves around the notion of preventing a second merge point which allows for the service to operate transparently with blockchain technology. Anonymity and paradoxically, transparency are the quintessential components of blockchain technology, and these can be utilized in an open payment system. At the time of payment, the user can clearly and easily check through the app how much discount the business received, unlike other payment methods, and that this amount of discount is possible only with the GemPay application. Instead of “you were charged x amount of won, please pay’, we become smart users by becoming the subject of payment data from consumers who used to make payments passively. This is one of the focal components of why GemPay is a practical solution in payment processing.

The third ethos of GemPay revolves around the controversy surrounding the coin price volatility. A justifiable question that small business owners ask themselves when utilizing blockchain and cryptocurrencies is “why would I accept such a volatile currency, I could make the transaction now and the value of the transaction can drop 20% in one minute”, which is a completely understandable sentiment. Afterall, a business must protect its profit and revenue streams. Blocko has conceived of an idea that will end this notion. Blocko will create AergoGem tokens on itself-developed AERGO mainnet to ensure 1:1 value exchange with fiat currency, and will initially focus on exchange with the KRW pair. Users can use the Gem charged through the GemPay app as in original currency and Gem can then be recharged with AERGO tokens, and you can also link third-party points with GemPay to exchange each point of the Gem. To conclude with a simple summary, GemPay allows for a high discount rate through its “double discount”, it enables transparency and independence through blockchain technology, and easy payments with gems that maintain 1:1 value with legal currency.

Disclaimer: Cryptocurrency involves substantial risk, do not invest more than you can afford to lose! I am not responsible for your trades!